Biden’s Student Loan Cancellation Plan: Legal Experts Weigh In on Supreme Court Prospect

5 min read

Image Source: KSDK

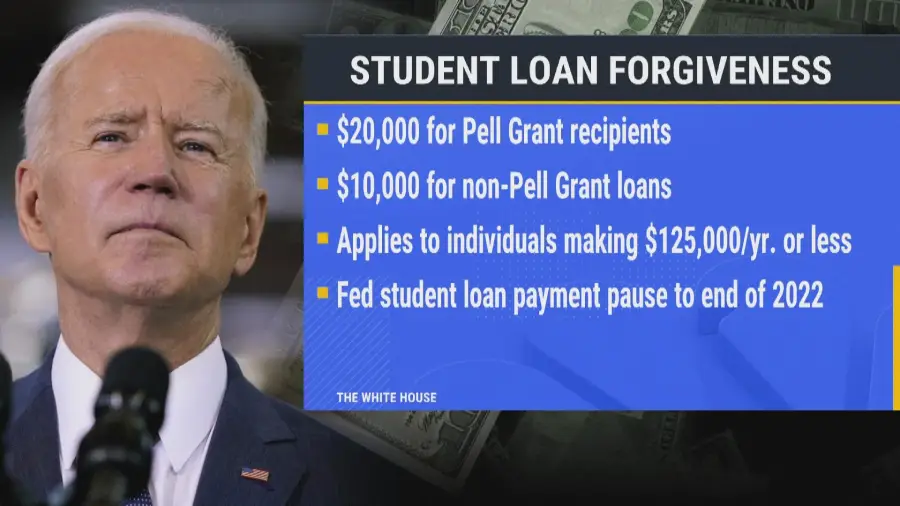

This week, the Supreme Court is scheduled to hold oral arguments on two legal challenges to President Biden’s plan to cancel student loans. If the plan proceeds, it could provide up to $20,000 in loan forgiveness to borrowers. The opposing parties have two main arguments to present: first, they assert their right to sue the administration, and second, they argue that the proposed student loan cancellation is illegal.

For the parties that are suing the administration to successfully argue that Biden’s plan is illegal. The first challenge they face is to establish their “standing” to bring the case. In order to have standing, a party must demonstrate that they have suffered or will suffer harm as a result of the administration’s actions. Although there has been a strong willingness to challenge the student loan forgiveness initiative, it has been difficult to find concrete examples of parties who can demonstrate actual damages.

Table of Contents

Supreme Court to Hear Cases on Biden’s Student Loan Cancellation Plan

On Tuesday, the Supreme Court will hear two cases in which each party asserts a different claim of standing. In the first case, filed by a coalition of Republican-led states, the argument is that the cancellation plan would result in revenue loss. These states used to generate revenue from federal student loans by operating guarantee agencies that helped service (i.e., collect repayment on) older federal student loans, specifically the Federal Family Education Loan Program loans. They also contend that the loan forgiveness would have tax implications, which would further reduce state revenue.

The second case presents a more conceptual argument, contending that the arbitrary nature of Biden’s plan would result in harm to borrowers who do not qualify for the full $20,000 in loan forgiveness. The plan provides $10,000 in forgiveness to some borrowers and excludes others from eligibility altogether. As a result, those who do not qualify for the maximum amount may suffer damages due to the inconsistency of the program’s application.

The administration asserts that neither case has valid standing and should not be pursued any further. However, if the court disagrees, the case will proceed to the central question of whether the White House has the authority to implement the program without legislative approval. This is a more fundamental issue that must be addressed to determine the legality of the student loan cancellation plan.

Exploring the Legality of Biden’s Student Loan Cancellation Plan: The HEROES Act and the Secretary of Education’s Authority

The White House contends that the 2003 HEROES Act grants them the power to cancel student debt. Originally enacted during the Iraq war to provide aid to service members and their families, this law permits the Secretary of Education to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs” under Title IV of the Higher Education Act “as the Secretary deems necessary in connection with a war or other military operation or national emergency.” It is evident that the secretary has some level of authority to alter loan conditions, but there is disagreement regarding whether the proposed student loan forgiveness program exceeds the authority granted by this law.

Three Republican co-sponsors of the 2003 law, former Rep. Howard “Buck” McKeon, former Rep. John Kline, and former House Speaker John Boehner, submitted an amici curiae brief in support of the upcoming case. They contend that the legislation they drafted does not empower the Secretary of Education to cancel student debt entirely. Rather, it provides the authority to alter loan regulations solely for borrowers who are directly affected by the national emergency at hand.

However, it appears that their Democratic counterparts, who co-sponsored or voted in favor of the legislation almost two decades ago, have a different perspective. Former Rep. George Miller stated in a recent op-ed for The Washington Post that the law did, in fact, intend to grant the Secretary of Education the authority to cancel student debt entirely. He also argues that the COVID-19 pandemic presents a suitable justification for such an intervention.

The Fate of Biden’s Student Loan Cancellation Plan Rests with the Supreme Court: What to Expect

The responsibility now lies with the nine Supreme Court justices to determine whether the parties have provided sufficient evidence of damages and if the administration is operating within its authority as it endeavors to cancel student debt for millions of borrowers. The courtroom is likely to be filled during the arguments, and a verdict could be rendered at any point after that. However, most anticipate that the ruling will be issued in June when the court typically releases its most significant decisions.

Frequently Asked Questions

Biden’s student loan cancellation plan aims to forgive $10,000 to $20,000 in student loan debt per borrower. It would provide relief to over 40 million Americans, mostly affecting those who have graduated from public universities or historically Black colleges and universities. The plan was initially proposed to help alleviate the economic impact of the COVID-19 pandemic.

Two legal challenges have been filed against Biden’s student loan cancellation plan. In the first case, Republican-led states argue that the cancellation plan would cause them to lose revenue. In the second case, the argument is more abstract, contending that the arbitrary nature of Biden’s plan would damage those borrowers who aren’t eligible for the full $20,000 in forgiveness.

To have standing, a party must prove they have or will experience damages as a result of the administration’s actions. The parties suing the administration must establish their standing to bring the lawsuit.

The White House claims that a 2003 law, the HEROES Act, gives them the authority to cancel student debt. The law gives the Secretary of Education the explicit authority to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs” under Title IV of the Higher Education Act “as the Secretary deems necessary in connection with a war or other military operation or national emergency.” There is a disagreement about whether the White House’s plan exceeds the authority granted by that law.

The Supreme Court is set to hear arguments on the two legal challenges to Biden’s student loan cancellation plan, and a ruling could come any time after the arguments. However, it is anticipated that the decision will come in June, when the court usually releases most of its significant decisions.