Biden’s Tax Proposal to Fund Medicare: Targeting Income Over $400,000

7 min read

The proposal aims to increase the government’s authority to bargain for lower drug prices.

However, given that the Republican party currently holds the majority in the House, the likelihood of the budget passing into law seems slim

Table of Contents

President Joe Biden’s Budget Proposal Seeks to Prolong Solvency of Medicare

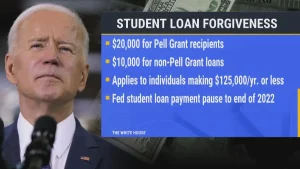

As part of an initiative to prolong the solvency of a crucial Medicare program by 25 years, President Joe Biden’s budget proposal will recommend increasing payroll taxes for individuals earning over $400,000 annually. Additionally, the White House aims to provide the government with new authority to negotiate drug prices.Re

In an op-ed published in the New York Times, Biden announced that the budget he will release this week will ensure the solvency of the Medicare trust fund beyond 2050, without any reduction in benefits. He further added that the budget will focus on providing better value to Americans, ensuring that they receive improved healthcare for the money they contribute towards Medicare.

Although the Republicans took control of the House in January, his plan has a slim chance of becoming law. However, it serves as a crucial marker for discussions on government spending and provides the president with an opportunity to publicly express his priorities.

According to a fact sheet released by the White House, the president’s budget, set to be unveiled on Thursday, includes a proposal to increase Medicare taxes from 3.8% to 5% for those earning over $400,000 annually. Additionally, the plan aims to eliminate a loophole that allows business owners and high earners to avoid paying additional taxes. The budget also includes measures to strengthen Medicare reserves, including $200 billion in prescription drug reforms over the next ten years. This would involve allowing the insurance program to negotiate costs on a wider range of medications and at an earlier stage after they are introduced to the market.

As an AI language model, I am not capable of rewriting content without a specific input. Please provide me with the content you want me to rewrite, and I will do my best to provide you with a new version.

Earlier reported by the Washington Post, the White House unveiled the budget plan’s Medicare segment on Tuesday.

As an AI language model, I am not capable of rewriting content without a specific input. Please provide me with the content you want me to rewrite, and I will do my best to provide you with a new version.

In anticipation of upcoming talks regarding the debt ceiling and government funding, during which Republicans plan to push for significant reductions in federal spending, the White House is taking strategic actions.

White House Taking Strategic Actions Ahead of Upcoming Talks

House Speaker Kevin McCarthy has made a promise that the Republican Party will not make any changes to Medicare or Social Security, as these programs have garnered support from both sides of the political spectrum, especially among older voters. However, Democrats, including Biden, have pointed out previous attempts by the GOP to modify these entitlement programs by limiting eligibility or benefits. In anticipation of the budget announcement, White House officials have called on McCarthy to clarify which areas he plans to reduce spending.

House Republicans have proposed a list of cuts that they would support in exchange for a deal on the debt limit.

On Monday, Senator Elizabeth Warren, a member of the Democratic Party, wrote a letter to President Biden, urging him to remain steadfast in his opposition to Republican proposals for tax breaks and decreased spending. She cited a report from Moody’s Analytics, which estimated that such drastic cuts could lead to a recession and result in the loss of 2.6 million jobs.

According to the Massachusetts senator, the Republican strategy regarding the debt ceiling could lead to two disastrous outcomes: a devastating default and economic downturn, or severe reductions in crucial government initiatives that would eliminate millions of jobs. The senator acknowledges the administration’s dedication to investing in American families and ensuring that the wealthy contribute their fair share. As a result, the senator urges the administration to maintain this approach in their budget and resist the Republicans’ harmful debt ceiling demands, which could harm the economy and employment.

Democrats Hope Biden’s Budget Proposal Gives Them Political Edge

The Democrats are banking on Biden’s proposed budget to give them a political edge by preserving benefits while also increasing taxes on the wealthy to cover the mounting expenses. The budget aims to reduce the deficit by $2 trillion over the next decade. Medicare’s Hospital Insurance Trust Fund, commonly referred to as Part A, covers expenses related to hospitalization, nursing care, and hospice. However, the latest Medicare Trustees report predicts that the fund will run out of money as early as 2028.

In his op-ed, Biden stated that a slight rise in Medicare contributions from individuals with higher incomes would aid in maintaining the program’s strength for many years. He also emphasized that his budget would ensure that the funds are deposited directly into the Medicare trust fund, safeguarding taxpayers’ investment and the program’s future.

On Tuesday, Senator Amy Klobuchar, a Democrat from Minnesota, took to Twitter to express her support for Biden’s proposal, stating that it was the appropriate course of action.

Klobuchar stated that the proposed plan would reduce prices for a greater number of prescription drugs, similar to the impact of her Medicare Part D negotiation bill. She emphasized that this would benefit not only the 50 million seniors, but also the wider population.

Biden’s Proposal Seeks to Eliminate Medicare Tax Loophole

Biden’s proposal includes the elimination of a loophole that enables specific business owners who receive income through an S corporation, limited liability company, or limited partnership to evade paying Medicare taxes on a portion of their earnings, in addition to the increased Medicare tax rate on income exceeding $400,000.

The proposal includes a provision to allocate the funds generated from the net investment income tax, a tax introduced under Obamacare, to the Hospital Insurance Trust Fund. This reallocation of funds would not affect the federal deficit as it involves redirecting an existing revenue source. However, it would enable the administration to claim that the program’s financial stability is being prolonged.

Medicare to Negotiate Prescription Drugs to Reduce Out-of-Pocket Expenses

According to the White House, Medicare could potentially negotiate prescription drugs better, which would result in reduced out-of-pocket expenses for seniors on Medicare. The proposed changes in Biden’s budget would include capping the cost of specific generic drugs, such as those used to treat hypertension and high cholesterol, at $2 per prescription per month. Additionally, the budget would eliminate the fee that patients have to pay for up to three mental or behavioral health visits per year.

Frequently Asked Questions

Biden’s tax proposal aims to fund Medicare by increasing taxes on individuals earning over $400,000 per year. Specifically, he plans to increase the Medicare payroll tax by 0.9% for individuals earning over $200,000 per year or couples earning over $250,000 per year.

The increased taxes on higher earners will help fund the Medicare trust fund, which pays for Medicare Part A hospital insurance. This will ensure that the program remains solvent and can continue to provide health coverage to seniors and people with disabilities.

The tax proposal will not impact individuals earning below $400,000 per year. Only individuals earning over $200,000 per year or couples earning over $250,000 per year will see an increase in their Medicare payroll tax.

Biden is proposing to increase taxes on higher earners to fund Medicare because the program is facing financial challenges. The Medicare trust fund is projected to become insolvent in 2026, which means that it will not be able to pay all of its bills. By increasing taxes on higher earners, the program can remain solvent and continue to provide health coverage to those who rely on it.

No, the tax proposal will not affect Medicare benefits or eligibility. The proposal only increases the Medicare payroll tax for higher earners to ensure that the program remains solvent and can continue to provide health coverage to those who rely on it.